NASDAQ: CYBR Reached a $10B Valuation

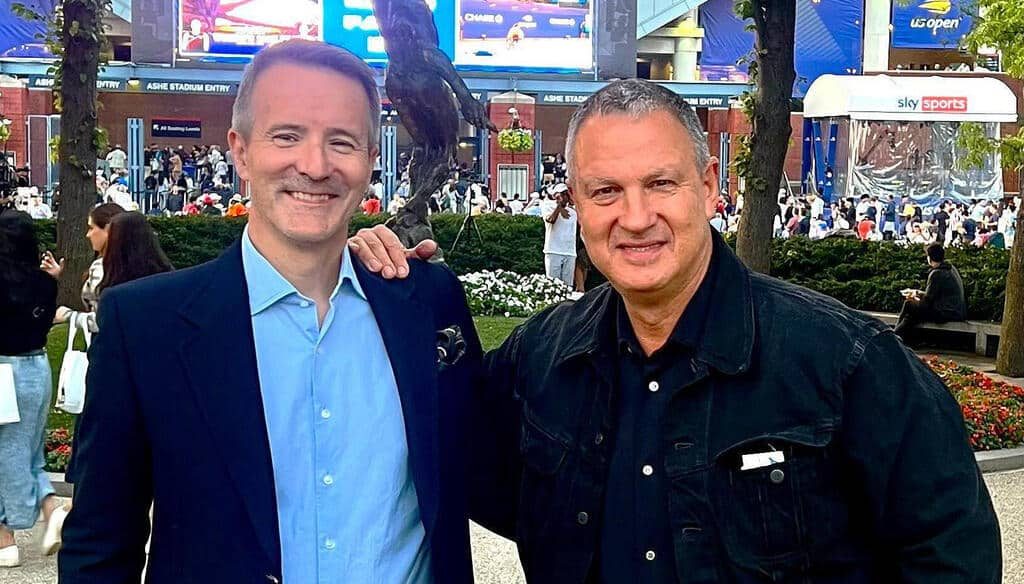

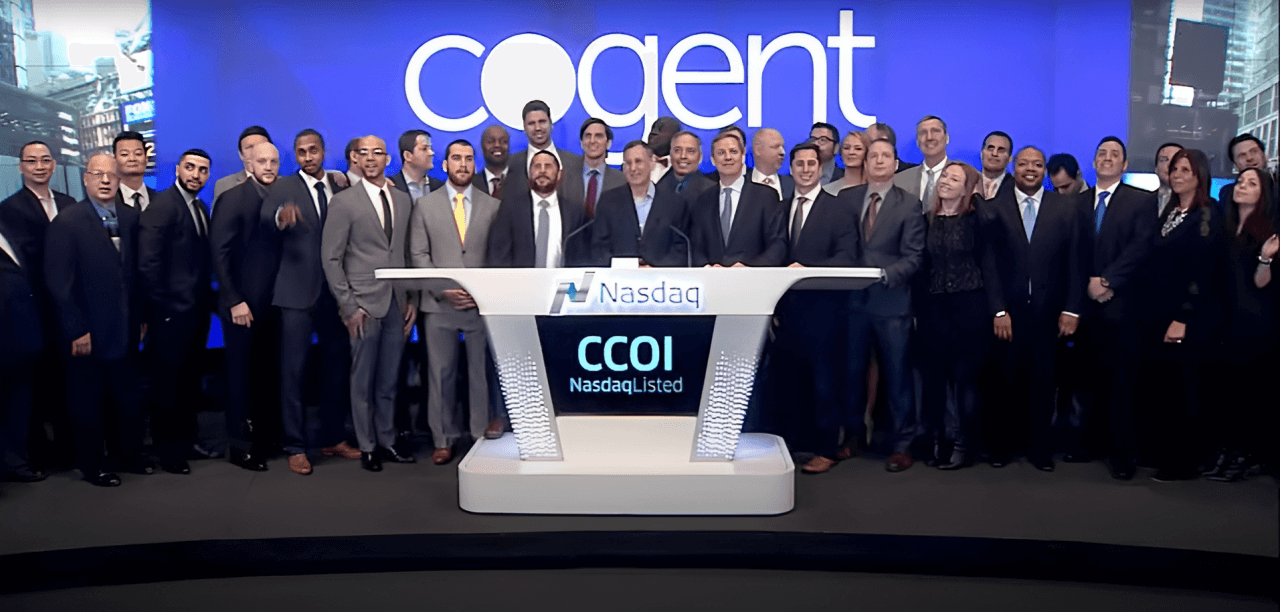

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: CYBR Reached a $10B Valuation

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: CYBR Reached a $10B Valuation

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CCOI Reached a $3.5B Valuation

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: CYBR Acquired by Palo Alto for $25B

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: PRSE Reached a $700M Valuation

NASDAQ: FNDT Reached a $310M Valuation

NASDAQ: FNDT Reached a $310M Valuation

Acquired by EMC for $460M

Acquired by EMC for $460M

NASDAQ: QLIK Acquired for $3B

NASDAQ: QLIK Acquired for $3B

NASDAQ: FNDT Reached a $310M Valuation

NASDAQ: FNDT Reached a $310M Valuation

Acquired by EMC for $460M

Acquired by EMC for $460M

NASDAQ: QLIK Acquired for $3B

NASDAQ: QLIK Acquired for $3B

Aquired by Lucent for $4.8B

Acquired by Avago

Acquired by Avago for $440M

reached a $5.5B valuation

NASDAQ: NTRO Reached a $5.5B Valuation

NASDAQ: NTRO Reached a $5.5B Valuation

Aquired by Lucent for $4.8B

Acquired by Avago

Acquired by Avago for $440M

reached a $5.5B valuation

NASDAQ: NTRO Reached a $5.5B Valuation

NASDAQ: NTRO Reached a $5.5B Valuation

Aquired by Lucent for $4.8B

Acquired by Avago

Acquired by Avago for $440M

reached a $5.5B valuation

NASDAQ: NTRO Reached a $5.5B Valuation

NASDAQ: NTRO Reached a $5.5B Valuation

Aquired by Lucent for $4.8B

Acquired by Avago

Acquired by Avago for $440M

reached a $5.5B valuation

NASDAQ: NTRO Reached a $5.5B Valuation

NASDAQ: NTRO Reached a $5.5B Valuation

Aquired by Lucent for $4.8B

Acquired by Avago

Acquired by Avago for $440M

reached a $5.5B valuation

NASDAQ: NTRO Reached a $5.5B Valuation

NASDAQ: NTRO Reached a $5.5B Valuation